Evaluation of the Effect of using Technical Analysis Indexes on the Returns of Investors

Abstract:

In this article, the effectiveness of eight different technical indexes including simple moving average, weighted moving average, exponential moving average, relative strength, commodity channel, stochastic, money flow and demand are examined by comparison between indexes returns with buy and hold returns. The results shows the return of Buy and Hold strategy is more than technical indexes in the year 2004 and is less than that in the years 2004 and 2006. This matter can be referred to the change in the market situations. The result of the repeated measures test indicates that there is no significant differences between the average returns of technical indexes and buy and hold strategy during studding years. Finally we show the coefficients of variation of some technical indexes used in this paper are lower and coefficients of variation of some other indexes are greater than coefficient of variation of buy and hold strategy. JEL

Language:

Persian

Published:

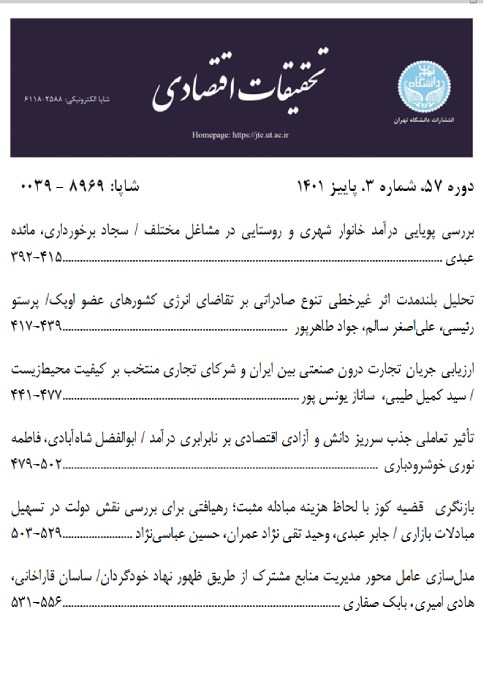

Journal of Economic Research, Volume:45 Issue: 92, 2010

Page:

23

magiran.com/p793593

دانلود و مطالعه متن این مقاله با یکی از روشهای زیر امکان پذیر است:

اشتراک شخصی

با عضویت و پرداخت آنلاین حق اشتراک یکساله به مبلغ 1,390,000ريال میتوانید 70 عنوان مطلب دانلود کنید!

اشتراک سازمانی

به کتابخانه دانشگاه یا محل کار خود پیشنهاد کنید تا اشتراک سازمانی این پایگاه را برای دسترسی نامحدود همه کاربران به متن مطالب تهیه نمایند!

توجه!

- حق عضویت دریافتی صرف حمایت از نشریات عضو و نگهداری، تکمیل و توسعه مگیران میشود.

- پرداخت حق اشتراک و دانلود مقالات اجازه بازنشر آن در سایر رسانههای چاپی و دیجیتال را به کاربر نمیدهد.

In order to view content subscription is required

Personal subscription

Subscribe magiran.com for 70 € euros via PayPal and download 70 articles during a year.

Organization subscription

Please contact us to subscribe your university or library for unlimited access!